Learning Management System (LMS)

Get the required training your dealership needs to remain compliant with every transaction and avoid costly fines

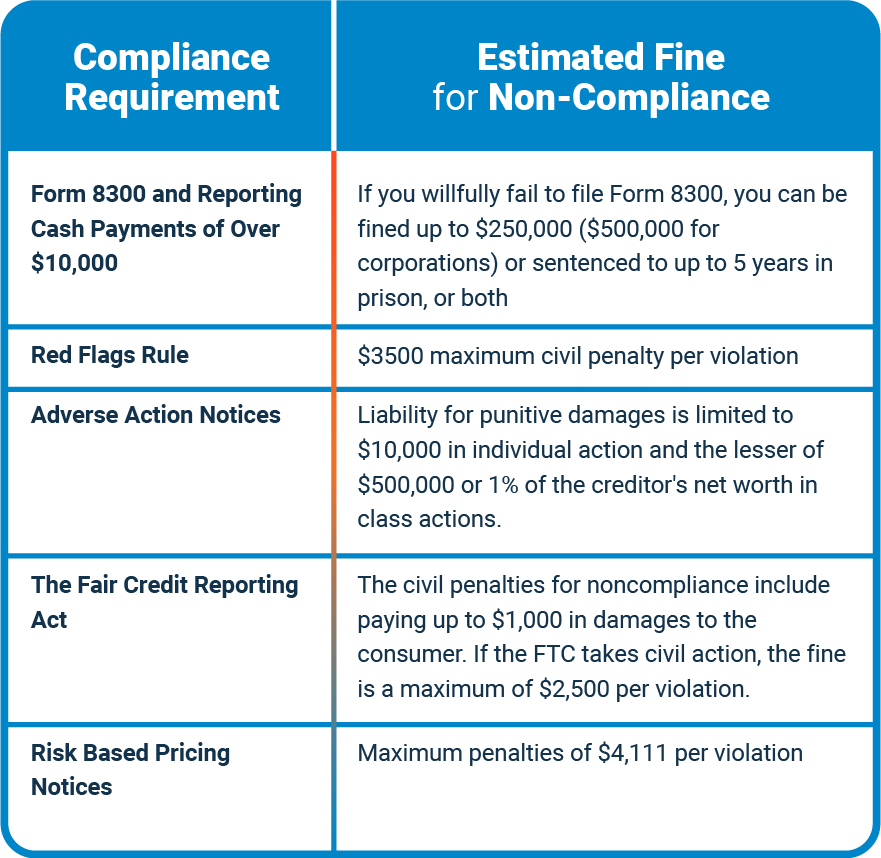

Can you afford to pay penalties for non-compliance?

To further our efforts in providing the best compliance and risk mitigation services to our clients, we are pleased to introduce our web-based, self-paced LMS which will provide the required training your dealership needs to remain compliant with every transaction and avoid costly fines.

Please fill out the form to keep your staff properly trained in compliance requirements. A 700Credit Representative will be in contact with you shortly.

Dealers are fined millions of dollars every year for not following the proper government regulations around the accessing and handling of customer’s sensitive credit data.

As the largest reseller of credit reports from all three bureaus – Experian, Equifax and TransUnion – 700Credit has always strived to provide a comprehensive and automated compliance solutions to keep you compliant with every credit report pulled.

What our Customers are Saying

The LMS, Baseline Learnings and Training Courses (BLT) platform includes the following 8 modules:

Adverse Action

This course helps to identify when information in a consumer report results in an adverse action and requires a proper notice to be provided to the customer as required by the Fair Credit Reporting Act (FCRA) and Equal Credit Opportunity Act (ECOA).

IRS Rule 8300

This course helps identify which transactions are considered cash transactions that require submission of an IRS Form 8300.

Paper Flow

This course reviews the importance and necessity of properly handing and retaining paperwork as required by GLB and the FTC Safeguards and Disposal Rules.

Privacy, Safeguards & Disposal

The goal of this course is to provide you with enough information so that you will know how to protect customers’ non-public information (NPI) as required by the Gramm-Leach-Bliley Act (GLB).

Red Flags Rule

This course helps dealership employees identify the red flags of identity theft and fraud, and to help prevent fraudulent conduct.

Risk Based Pricing Rule

This course describes the risk-based pricing rule and best practices you need to follow at your dealership to comply.

UDAAP

Unfair, Deceptive, or Abusive Acts or Practices (UDAAP)

This course provides information on avoiding acts and practices that can be unfair, deceptive, or abusive – and illegal.

OFAC

This course will help your dealership comply with the Office of Foreign Asset Controls (OFAC) requirement that car dealers check customer names against a database of known dangerous organizations and individuals.

This LMS meets the guidelines set forth by the 3 major credit bureaus on the rules and regulations all business must follow when pulling a credit report and is required for every dealership that uses our credit report solution.